A bad credit report can happen for a number of reasons: bankruptcy, delayed payments on bills, non-payment of bills, maxed-out credit cards, too many credit inquiries and mistaken identity.

Whatever the reason, there is no need to worry and panic because there are several ways on how to repair your credit report that will increase your credit score and have you in good credit standing once again.

How to Repair Your Credit Report

1. Patience is a virtue. The very first thing that you have to keep in mind when fixing your credit report is that these things take time – lots of time. So unless you have the patience and determination to see this through, you may never get that good credit report that you want.

Usually, fixing your credit report will take at least six months to a year, sometimes more; depending on how badly the state of your credit report is in.

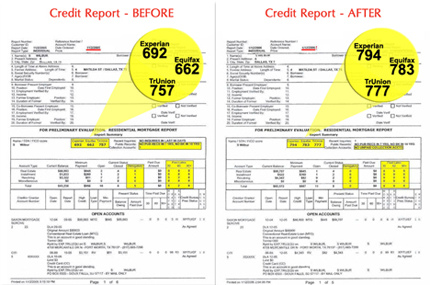

2. Current standing. While you may already know that you have a bad credit report because you are aware of your late payments, non-payments and current financial situation that may have rendered you unable to meet your responsibilities to your creditors; it will help if you know your exact credit standing.

This means you have to obtain your updated credit report from credit bureaus. This will help you check if all items listed therein are accurate or if there are areas that you may need to dispute.

Note: If there are disputes, you must immediately inform the corresponding credit bureau as well as creditors that may have given erroneous information about your history.

3. Credit restoration agencies. There are specific agencies that can help you work on your credit report. They employ credit restoration professionals who can walk you through the whole process of restoring your good credit standing, guide you step-by-step and also help you with disputes and such.

While you may have to pay a small fee for their services, the benefits of having your good credit standing restored are incomparable to this minimum professional fee.

However, if you do decide to hire a professional credit restorer to work on your credit report, you should be selective about who to work with.

Getting referrals from friends or family who may have worked with specific credit restorers and had their credit standing successfully restored is highly advisable.

4. Personal contribution. On your part, you have to work out a compromise with your creditors so you can gradually pay for what you owe them. This will tremendously help increase your credit score.